Expense Types

Organize a Report by Expense Type

Organizing a report by expense type can make it easier to review expenses on a report.

- Open the desired report.

- Click Details in the upper right corner of the report.

- Click the View dropdown and select Detailed.

- Click the Split by dropdown and select Reimbursable or Billable.

To group the expenses by category or tag, you can also click the Group by dropdown and select Category or Tags.

Identify Expense Types

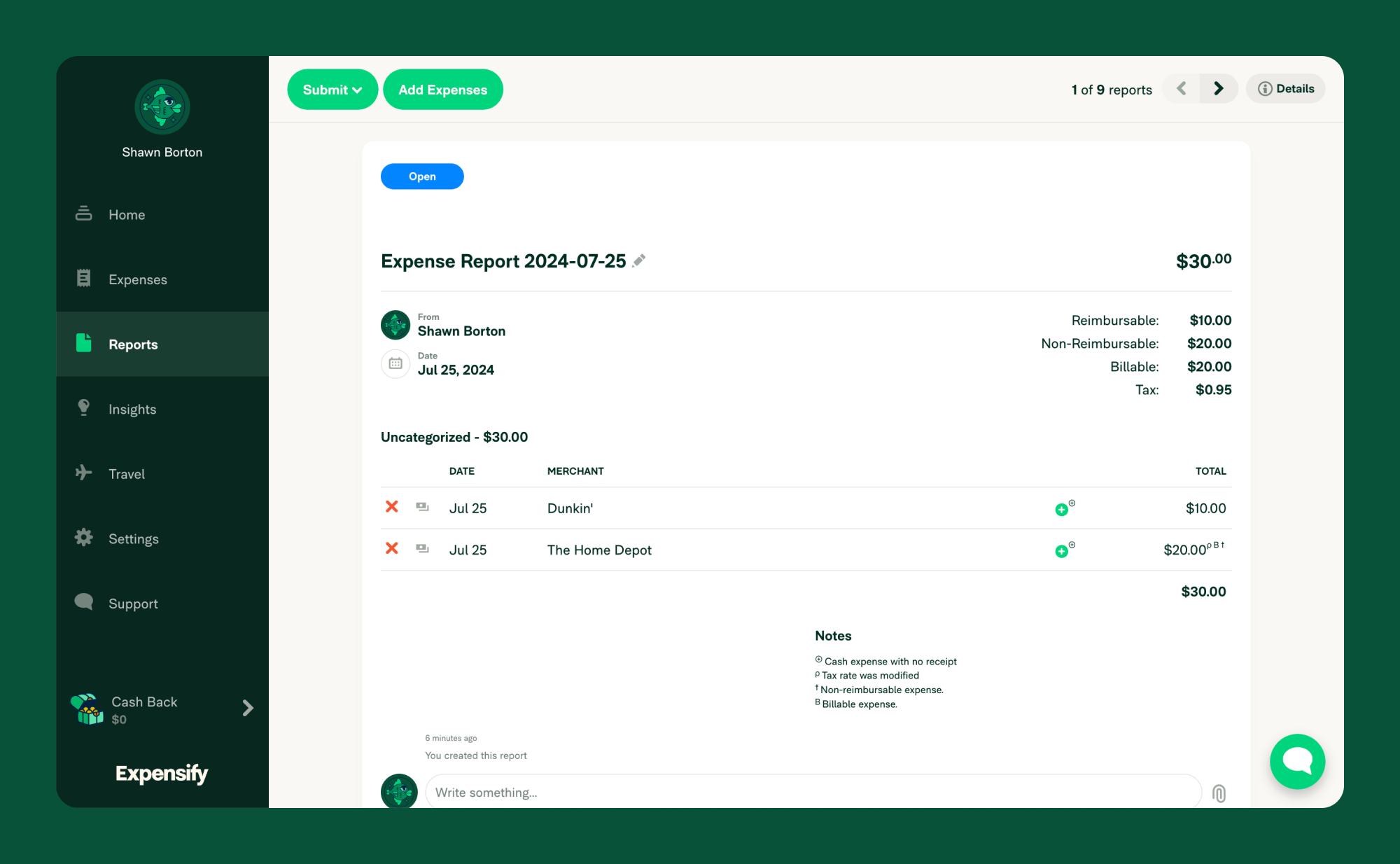

The right side of every report provides the total for all the expenses. Under the total, there is a breakdown of reimbursable, billable, and non-reimbursable amounts (depending on the expense types that exist on the report).

- Reimbursable expenses: Expenses paid to the employee, including:

- Cash & personal card: Expenses paid for by the employee on behalf of the business.

- Per diem: Expenses for a daily or partial daily rate configured in your Workspace.

- Time: An hourly rate for your employees or jobs as set for your workspace. This expense type is usually used by contractors or small businesses billing the customer via Expensify Invoicing.

- Distance: Expenses related to business travel.

- Non-reimbursable expenses: Expenses directly covered by the business, typically on company cards.

- Billable expenses: Business or employee expenses that must be billed to a specific client or vendor. This option is for tracking expenses for invoicing to customers, clients, or other departments. Any kind of expense can be billable, in addition to being either reimbursable or non-reimbursable.

FAQ

What’s the difference between an expense, a receipt, and a report attachment?

- Expense: Created when you SmartScan or manually upload a receipt from a purchase.

- Receipt: A picture file that is automatically attached to the expense during the SmartScan process.

- Report Attachments: Additional documents that need to be submitted to your approver (e.g., supplemental documents to the purchase) can be added to a report any time by clicking the paperclip icon in the comments at the bottom of the report.

How are credits or refunds displayed in Expensify?

In Expensify, a credit is displayed as an expense with a minus in front of it (e.g., -$1.00). Expensify defaults all expenses as something that needs to be paid by the company. So a credit that is returned to the company is displayed as a negative expense.

If a report includes a credit or a refund expense, it will offset the total amount on the report. For example, if the report has two reimbursable expenses, one for $400 and one for $500, then the total reimbursable amount is $900. Conversely, an expense for -$400 and one for $500 will be a total reimbursable amount of $500.